NEW YORK – Early Warning Services, LLC., the network operator of Zelle®, today announced that Zelle experienced double-digit year-over-year growth across key segments in the first six months of 2025:

- American consumers and small businesses sent and received 2 billion payments, a 19% increase.

- Total dollar amount sent is up by 23%, from $481 billion to nearly $600 billion.

- The total number of payments to small businesses jumped up by 31% to 180 million. This is currently the fastest growing use of Zelle.

“With continued surging growth, it’s clear Zelle is where the U.S. economy flows,” said Denise Leonhard, general manager of Zelle. “Whether it’s rent, childcare or paying a small business, Zelle is an essential and foundational part of everyday life for millions of Americans. Zelle delivers when the moment demands speed and reliability at scale. In a time when people need their money to move fast and work hard, Zelle is showing up.”

Tracking the Pulse of the Economy, One Payment at a Time

Zelle had its biggest month ever in August, with over $108 billion sent, cementing its place as a central player in the U.S. economy. And when the most common Zelle payments on any given day go toward rent and monthly recurring living expenses like paying a roommate back for utilities, it’s a clear reminder that Zelle isn’t just about convenience – it’s part of how Americans stay housed, support their families and remain connected to the communities they help make vibrant.1

Increasingly, Zelle is emerging as an economic signal – playing a quiet but critical role in America’s affordability story, sending money quickly for essentials like rent and childcare. In many ways, Zelle offers a snapshot of broader American spending patterns that run counter to some of today’s dominant economic trends, particularly with superusers – those that have adopted and already use Zelle the most.

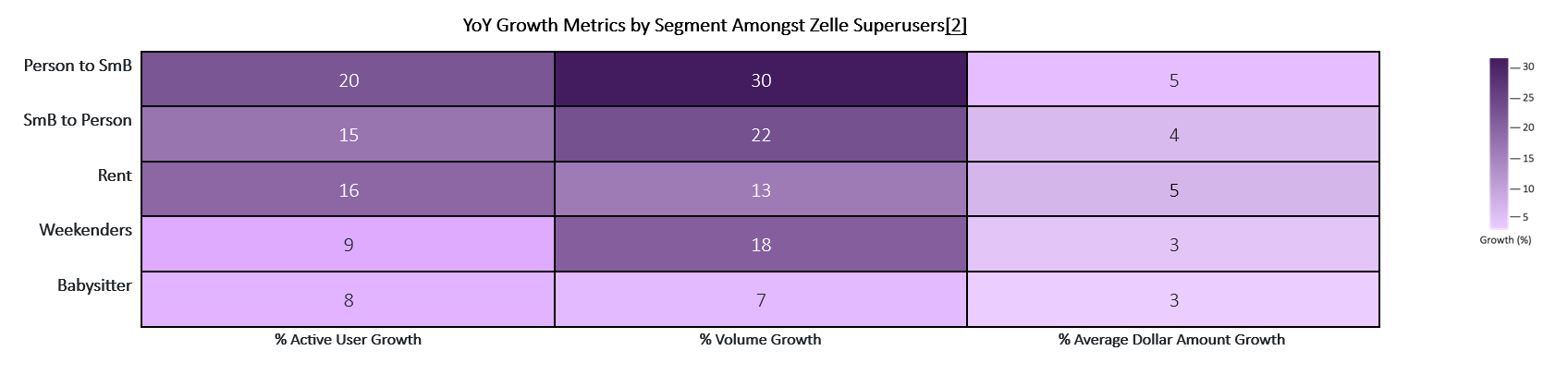

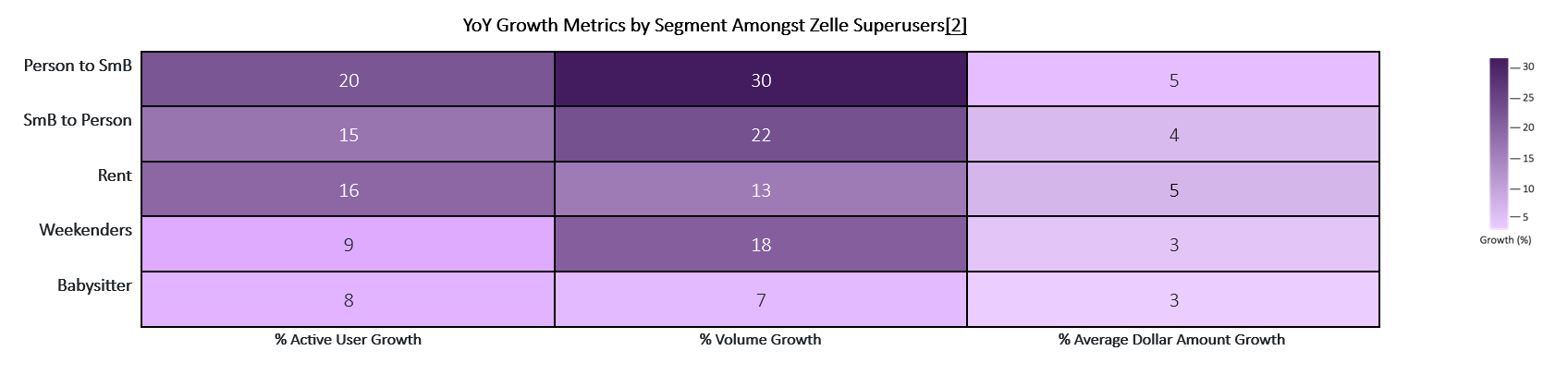

What the Growth Metrics Can Tell Us

While headlines focus on signs of consumer pullback, changing retail sales and softening consumer sentiment, Zelle data shows something different: Americans are still moving money with intent, still hiring babysitters and still supporting small businesses. And they are choosing Zelle to do it:

- Person-to-small-business payments jumped 30% in volume, with average payment size up 5%, reflecting continued support for local services and entrepreneurship – even as broader small business sentiment might be uncertain.3

- Payouts from small businesses to individuals rose sharply by 22%, a possible sign of the growing role of Zelle in the gig and independent workers, where fast payments often help them bridge essential needs like groceries, rent or childcare.

- The number of rent payments grew by 13% with the average rent payment rising 5% (from $914 to $958) – reflecting both the pressure of housing costs and growing reliance on fast payments for major financial obligations.

- Payments over the weekend, when many Americans do things like run errands, make farmer’s market runs or go to local events like street fairs, rose 18% while average payment size stayed relatively consistent. This suggests cautious but consistent discretionary activity.

- Childcare payments (to babysitters) increased by more than 7% with the average amount up 3% to $174 – families are keeping support systems in place despite tighter budgets.

In other words, everyday financial life remains active and resilient—and Zelle is the way people are getting it done.

Inside the Zelle ‘Trust Signal’ Tech Stack Fighting to Protect American Consumers

Zelle and Early Warning, the company behind Zelle, are leading the fight to protect Americans from criminals – both domestic and foreign – who use calls, texts, direct messages and online marketplaces to trick people into giving them their money.

“Early Warning is the most powerful financial crime-fighting company you’ve never heard of,” said Ben Chance, general manager of Early Warning’s Identity and Payments Risk business. “For more than 30 years, we’ve worked with banks and law enforcement to stop billions in fraud and financial crime – everything from organized crime rings to kidnappings – with agencies ranging from the FBI and U.S. Postal Inspection Service to local police. We’ve also worked closely with federal agencies including the U.S. Treasury and Federal Reserve Bank to stop hundreds of thousands of improper federal payments worth hundreds of millions of dollars. That same expertise powers Zelle, helping protect the money of hardworking American consumers and small businesses every day.”

While others are only now rolling out AI, machine learning and in-app alerts, Zelle has continuously evolved its cutting-edge anti-fraud and scam technology to protect Americans, and is backed by Early Warning, a company with a 30-year financial crime-fighting legacy:

- Zelle uses billions of ‘Trust Signals’ that allow us to identify patterns, pinpoint criminals and block scammers from using Zelle.

- Protecting consumers is central to how Zelle operates, and our technology helps ensure that once bad actors are identified, they cannot return to the network.

- We have always enforced strong anti-fraud rules and deployed robust cutting-edge consumer protection technology since the network launched in 2017—and we move swiftly to find, investigate and fight threats.

- We provide next-generation predictive fraud detection technology at no cost to participating banks and credit unions, empowering them to proactively stop suspicious payments in real time—before money ever leaves a consumer’s account. This means we – and the financial institutions that offer Zelle – can quickly adapt as new fraud and scam trends occur.

Currently only 0.02% of all Zelle transactions result in a report of fraud or scam. While that number could always change as we bring new product features online and criminals continue to evolve their tactics, that means more than 99.98% of Zelle transactions are without report of fraud or scam, an extraordinary rate in payments.

For perspective, you are more likely to get food poisoning (3%), be in a car accident (around 2%) or get injured by a toilet (0.07%) than experience fraud or scam related to Zelle as a payment method today.

About Zelle®

Zelle® powers fast, reliable person-to-person digital payments, moving more than $1 trillion between millions of consumer and small business accounts at United States banks and credit unions. Available through a network of more than 2,300 financial institutions, Zelle® enables people to send and receive money directly – without cash, checks or third-party apps. Zelle® is owned and operated by Early Warning Services, LLC, which works with America’s banks, credit unions and government agencies to drive prosperity, deliver bold innovation and improve how payments are made. Learn more at www.zelle.com.

1 Based on limited available and self-reported 2024 and 2025 memo field data.

2 This chart is based on analysis of limited available and self-reported 2024 and 2025 memo field data for Zelle superusers, who are the top 20% most active users of Zelle and represent 60% of total network volume.

3 According to the U.S. Chamber of Commerce 2025 Small Business Index, while more small businesses reported being in good health in Q2 than in Q1, concerns about the future persist.